Welcome to State of the Market, our monthly round-up of key property market updates, with actionable insights for small and medium-sized property developers.

Key takeaways – at a glance:

- UK house prices steady in June – +1.6% year-on-year

- Renewed buyer activity signals underlying demand

- Government launches National Planning Tool for site viability

- Self-build and SME planning reforms move forward

- RICS advocates for long-term housing delivery strategy

Key takeaway 1: UK house prices steady in June – +1.6% year-on-year

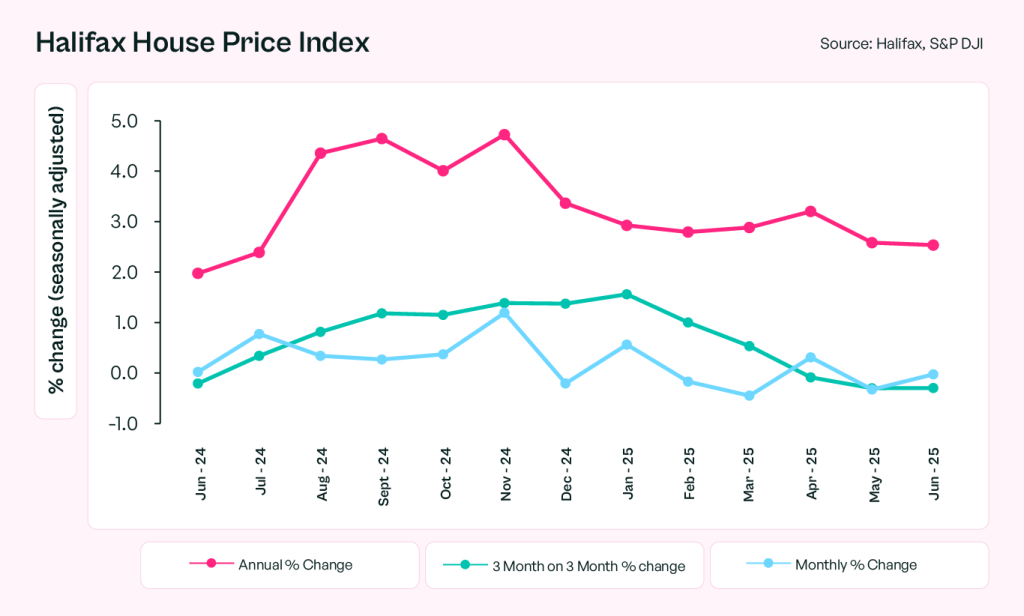

The Halifax House Price Index shows that UK house prices were unchanged month-on-month in June, holding at an average of £288,455. Year-on-year growth remains positive at +1.6%, reflecting a relatively stable market midway through 2025.

“This continued stability provides a platform for confidence to grow, especially as affordability slowly improves,” said Amanda Bryden, Head of Mortgages at Halifax,” said Amanda Bryden, Head of Mortgages at Halifax.

Full report: https://www.halifax.co.uk/media-centre/house-price-index.html

While affordability constraints persist in some regions, areas with strong wage growth and access to employment centres continue to attract interest. Buyers remain price-sensitive, but many are now re-entering the market with a longer-term outlook.

What this means for SME developers:

Solid fundamentals are supporting steady pricing. Focus on entry-level and mid-market homes aligned with local affordability. With modest price growth and fewer pricing shocks, summer is likely to see better deal-making conditions.

Key takeaway 2: Renewed buyer activity signals underlying demand

Recent data from Garrington indicates a “renewed buzz” in the residential market, with increased viewing volumes and faster decision-making among buyers. Downsizers, upsizers, and cash buyers are particularly active, along with location-led movers.

Market review: https://www.garrington.co.uk/market-review/june-2025-uk-property

Despite ongoing economic headwinds, many buyers are responding to stabilised pricing and the potential for further interest rate cuts later in the year. Demand for well-located homes with strong EPC ratings remains strong.

What this means for SME developers:

Early signs of returning buyer confidence are starting to shape market behaviour. Target stock to where demand is showing signs of life. Re-engage with local agents to understand where buyer appetite is shifting and how to price appropriately.

Key takeaway 3: New National Planning Tool promises site viability clarity

July saw the official launch of the National Planning Data Platform – a tool that enables planners and developers to assess site constraints and connectivity with more precision and consistency.

Announcement: https://assets.publishing.service.gov.uk/media/686d3100a08d3a3ca3b678d6/5_Chief_Planners_Newsletter_July_25.pdf

This innovation could lead to faster pre-application assessments and improved transparency on whether a site is likely to be developable – saving time and cost for smaller developers.

What this means for SME developers:

Better access to planning data is a boost for SME developers. Start incorporating this tool into site-sourcing and feasibility analysis. Quicker insight into key constraints will help de-risk early-stage planning and improve investor and lender confidence.

Key takeaway 4: SME-focused planning reforms gaining traction

The Government’s planning reform agenda is gaining momentum, with a renewed focus on empowering smaller builders, custom homes, and self-build projects. Recent updates include proposals for streamlined consent processes for developments of fewer than 10 homes, increased emphasis on local support for small sites, and a shift toward plot-based delivery models designed to enable faster planning decisions.

Policy coverage:

- https://www.homebuilding.co.uk/news/the-new-planning-reforms-that-could-help-self-builders-fix-britains-broken-housing-market

- https://mhclgmedia.blog.gov.uk/2025/07/08/coverage-on-the-governments-planning-reforms

These changes signal a growing recognition that SME developers are vital to unlocking housing delivery – particularly on infill and edge-of-settlement sites.

What this means for SME developers:

Policy is increasingly shifting in favour of smaller, more agile developers. Reassess smaller plots previously seen as too complex or marginal. Local authority appetite for SME-led solutions is rising, and streamlined routes could make more sites stack up.

Key takeaway 5: Industry calls for long-term strategy

RICS’ June influence update highlights the need for long-term thinking in housing delivery, particularly around planning certainty, infrastructure, and regional investment. The Institute has advocated for stable pipelines, SME support, and a “mission-driven” housing strategy.

Read the update: https://www.rics.org/news-insights/uk-influence-advocacy-update-june-2025

The call aligns with other industry voices urging Government to sustain reform momentum and keep smaller developers front-of-mind as enablers of growth and regeneration.

What this means for SME developers:

Momentum is building but consistency matters. Engage with local planning consultations and developer forums to make your voice heard. Track funding schemes and infrastructure initiatives that may align with your patch or project pipeline.

And finally…

Here are five articles we think you’ll find valuable this month:

- Fixing the planning system for SME developers? – Savills Research

- Bridging loans forecast to hit £12 billion in 2025 – Independent

- What is the Government’s New Housing Bank? How funds might be available for your housing project – Home Building

- UK builders gear up for post-pandemic boom despite global gloom – The Guardian

- Warning issued to government over building 1.5 million homes pledge – Independent

Steve Deutsch, CEO of CrowdProperty, comments:

“It’s encouraging to see both stability in the housing market and meaningful progress in planning reform. These are precisely the ingredients needed to support SME developers. We now need to maintain this momentum. Focus on agile, viable sites, and be ready to move as lending and policy clarity improve.”

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant decision in principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded