Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights tailored for small and medium-sized property developers.

Key takeaways:

- House prices return to growth – +2.4 % year-on-year

- Bank of England cuts base rate to 4.00% – first drop since May

- Mortgage affordability improves – boosting buyer activity

- Construction activity slows – contractors under pressure

- “Zombie listings” clouding true housing supply picture

1. House prices return to growth – +2.4 % year-on-year

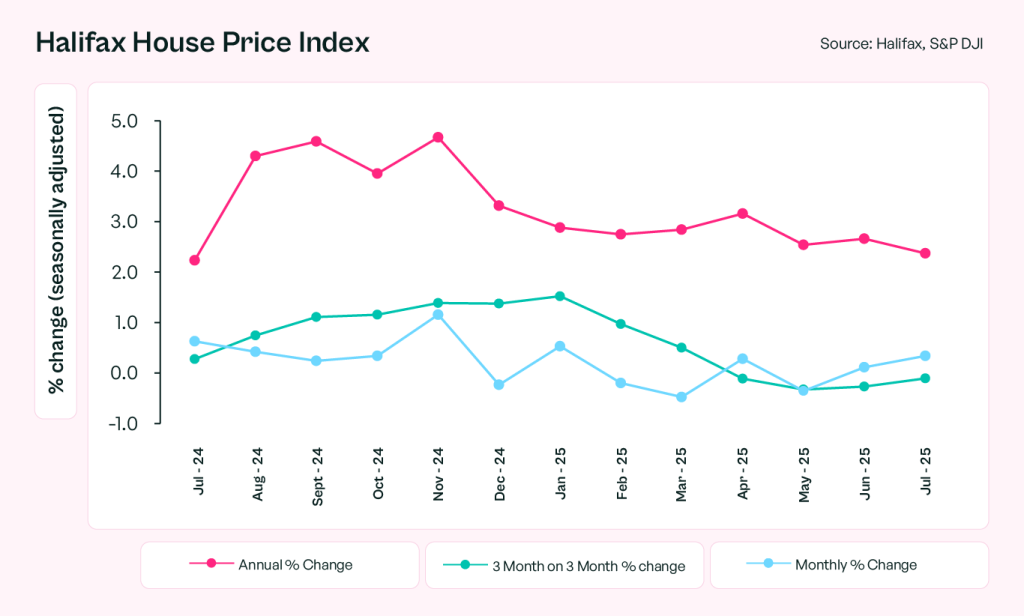

After a period of stability, house prices in July edged up again. Nationwide reported a 0.6 % monthly rise, bringing annual growth to 2.4% and the average UK house price to £272,600. Halifax data recorded a 0.4 % monthly increase and the same 2.4% annual growth, with an average price of £298,200.

“This is further evidence of a market that continues to adjust gradually, supported by improving affordability,” said Amanda Bryden, Head of Mortgages at Halifax.

Source: Halifax House Price Index

What this means for SME developers:

Affordability is gradually improving, enabling measured price growth. Developers should position stock within value-sensitive bands and lean on both valuation trends and agent insights when pricing.

2. Bank of England cuts base rate to 4.00% – first drop since May

On 7 August, the Bank of England cut the base rate from 4.25% to 4.00%, marking its second cut of the year and first since May. The decision came after a closely split MPC vote (5–4), requiring a rare second round of voting. The cut aims to ease financing conditions and support consumer confidence.

“This is a signal that the Bank is prepared to act – though further cuts are likely to be incremental,” said analysts at Capital Economics.

Source: Live Market Reaction – The Guardian

What this means for SME developers:

Lower rates could support buyer affordability, mortgage approvals, and development finance costs. However, developers should still assume conservative buyer budgets and lock in favourable borrowing terms early.

3. Mortgage affordability improves – boosting buyer activity

New rules enhancing mortgage affordability have increased borrowing capacity by up to 20%, sparking renewed interest from first-time buyers. Zoopla reported an 11% increase in buyer demand and 8% more agreed sales year-on-year. However, asking prices in some segments remain too high for market conditions, causing properties to linger or be relisted at reduced rates.

Source: The Guardian – Mortgage Rules Boost Activity

What this means for SME developers:

The boost to affordability is a timely opportunity. Focus on well-priced, energy-efficient homes in accessible locations. Monitor sentiment to ensure pricing aligns with what buyers are genuinely willing and able to pay.

4. Construction activity slows – contractors under pressure

The UK Construction PMI fell sharply to 44.3 in July – its lowest since the pandemic recovery began — driven by a drop in housebuilding activity and contractor workload. Capacity constraints, high input costs, and delays in approvals are weighing on SME delivery prospects.

Source: The Guardian – Business Live

What this means for SME developers:

Secure contractors early and account for delivery delays in programme planning. Supply chains are fragile, so maintaining flexibility in project timelines is essential.

5. “Zombie listings” clouding true housing supply picture

While listings appear to be rising, analysts caution that much of this is “recycled stock” – unsold homes that have been relisted with minor changes. These so-called “zombie listings” may create a false impression of strong supply, particularly in slower-moving price bands.

Source: Homebuilding & Renovating

What this means for SME developers:

Ground-level intel is more important than ever. Don’t rely solely on portal data – talk to agents, review transaction volumes, and focus on submarkets with genuine buyer movement.

Steve Deutsch, CEO of CrowdProperty, comments:

“July saw the return of modest growth, and with the August rate cut, buyer confidence should pick up pace. But market friction remains – from pricing mismatches to contractor strain. Developers who price smart, plan cautiously, and lean on trusted relationships are best placed to take advantage.”

And finally…

Here are five timely reads to keep you informed this month:

- Where Next for House Prices? – Savills Research

- The Rise of Modular Housing in the UK – Building Design + Construction

- 10 Tips for Smoother Planning Approvals – Planning Resource

- Land Value Capture and Infrastructure Funding – Centre for Cities

- Skills Shortages: The Next Hurdle for Housebuilding – Construction News

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded