Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights tailored for small and medium-sized property developers.

Key takeaways:

- House prices hit record high – but growth cools to +2.2%

- Rate cut fuels cautious optimism – but buyers remain selective

- Mortgage approvals reach highest since Jan – activity recovering

- Construction still contracting – but pace of decline eases

- Rental market tightens – strong demand meets falling supply

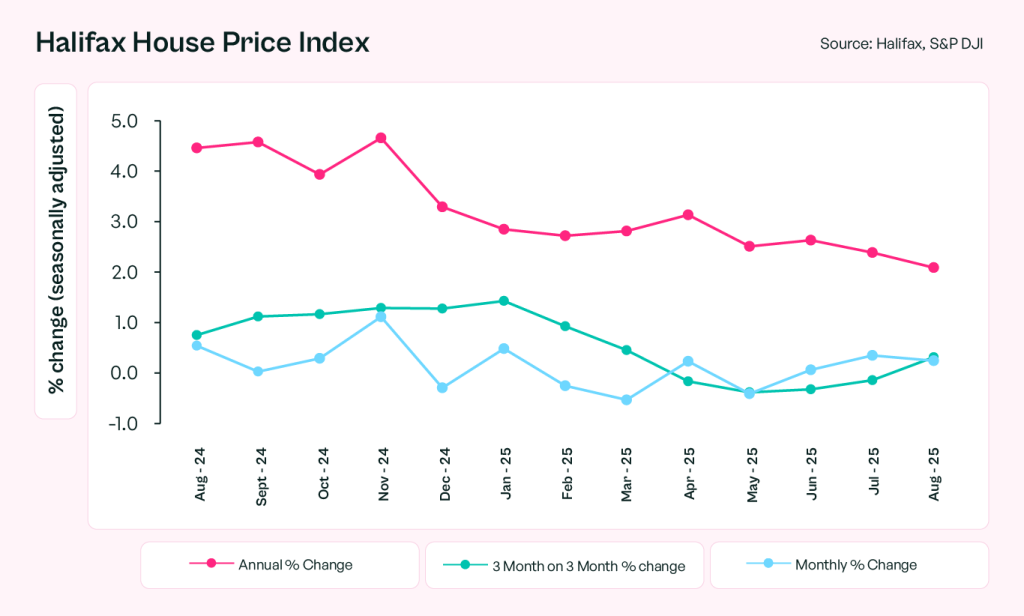

1. House prices hit record high – but growth cools to +2.2%

According to the Halifax House Price Index, average UK house prices rose to £299,331 in August – a new record and the third consecutive month of increases. However, the annual rate of growth eased slightly to +2.2%, down from 2.5% in July, continuing a trend of modest gains rather than runaway inflation.

This reflects a market that is gradually stabilising, with limited supply underpinning prices while affordability constraints temper demand. Halifax notes that while confidence is returning, buyers remain price-sensitive and focused on value – particularly in regions with strong local economies or access to employment centres.

“This continued upturn reflects the cautious return of market confidence,” said Amanda Bryden, Head of Mortgages at Halifax.

Source: Halifax House Price Index

What this means for SME developers:

The market is stable but not surging. Developers should factor in modest pricing assumptions and avoid over-reliance on future growth. Focus on realistic GDVs, good-quality locations, and products aligned with local affordability bands.

2. Rate cut fuels cautious optimism – but buyers remain selective

Following the Bank of England’s decision to cut the base rate to 4.00% in early August, the market has responded with a mixture of relief and restraint. Lenders have begun to reduce rates on selected mortgage products, improving affordability for some borrowers – especially those with strong equity positions or smaller loan-to-value ratios.

Despite this, many prospective buyers remain hesitant, citing broader economic uncertainty, stagnant wage growth, and cost-of-living pressures. As a result, while sentiment has improved, demand remains concentrated in specific submarkets – notably among downsizers, relocators and well-capitalised buyers.

Source: FT Adviser

What this means for SME developers:

The rate cut is a helpful tailwind, but not a game-changer on its own. Developers should focus on products suited to confident buyer groups – such as energy-efficient homes, well-connected commuter stock, or schemes targeting older or cash-rich demographics. Use this window to lock in favourable development finance terms.

3. Mortgage approvals reach highest since Jan – activity recovering

Mortgage approvals rose to 65,400 in July – the highest level since January, according to Bank of England data. This uptick suggests improving buyer sentiment following months of subdued activity and points to a gradual reawakening in housing transactions.

The approval growth reflects the combination of stabilising house prices, improved affordability due to falling rates, and increased lender competition. However, first-time buyers still face barriers around deposit requirements, and many transactions are taking longer due to cautious underwriting and stricter affordability checks.

Source: Trading Economics

What this means for SME developers:

The pipeline of potential buyers is beginning to rebuild. Developers should prepare market-ready stock with strong EPC ratings and sharp pricing. Working closely with brokers and agents will be key to navigating cautious buyer journeys and shortening sales cycles.

4. Construction still contracting – but pace of decline eases

The UK Construction PMI rose slightly to 45.5 in August, up from 44.3 in July – still in contraction territory (anything below 50) but showing signs of stabilisation. Residential activity remained the weakest-performing area, though commercial and infrastructure work provided some balance.

Key challenges remain in planning delays, labour shortages, and persistent material price pressures – particularly for aggregates and imported products. Some smaller contractors are also facing tighter cashflows, leading to reduced availability and rising premiums for guaranteed timelines.

Source: Builders’ Merchants News

What this means for SME developers:

Delivery risk is still high. Developers should build extra contingency into project timelines and ensure contractors are well-vetted and financially stable. Where possible, phase works or pre-agree costs with suppliers to mitigate price fluctuations. Cashflow discipline remains critical.

5. Rental market tightens – strong demand meets falling supply

Private rents continue to rise as supply shrinks. Landlords are reducing portfolio exposure or pausing acquisitions due to tax burdens, regulatory shifts, and squeezed margins. Meanwhile, tenant demand – especially in regional cities and commuter zones – remains strong, driving rents to new highs.

The RICS August market survey noted a fifth consecutive month of falling landlord instructions, further tightening stock levels. This mismatch is worsening affordability for renters and fuelling increased competition, particularly among young professionals and mobile workers.

Source: Financial Times

What this means for SME developers:

Build-to-rent and mixed-tenure schemes remain strategically sound in undersupplied markets. Where feasible, consider allocating a portion of schemes to rental stock – especially in areas with high employment and limited new supply. Model yields carefully and account for ongoing regulation and compliance costs.

Steve Deutsch, CEO of CrowdProperty, comments:

“August’s data shows a cautiously optimistic market – interest rates are easing, mortgage activity is recovering, and pricing remains resilient. That said, delivery risks remain real. Developers who combine smart pricing, operational discipline and fast execution are in a strong position heading into Q4.”

And finally…

Here are five timely reads to keep you informed this month:

- UK Economy Stagnates in July as GDP Flatlines – Financial Times

- Property Market Confidence Falls Again, Says RICS – MoneyWeek

- Halifax House Prices Rise for Third Consecutive Month – MoneyWeek

- Londoners Buying Fewer Homes Outside the Capital – The Guardian

- Sterling Slips as Economy Stagnates and Rate Expectations Shift – Reuters

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded