Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights, tailored for small and medium-sized property developers.

Key takeaways:

- House-price growth holds but remains modest – annual +2.4%

- Vendor/seller caution ahead of Budget – listings and instructions fall

- New-build land availability still tight – fewer greenfield and brownfield sites

- Planning appeal workloads climb – decision times remain stretched

- Supply chain & build cost inflation – stronger than interest-rate headwinds

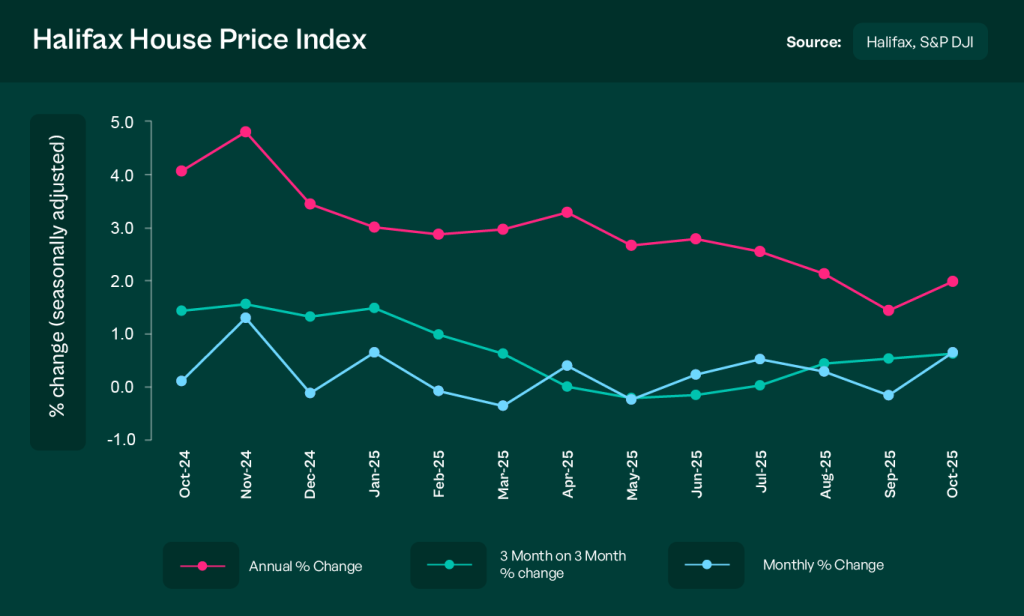

1. House-price growth holds but remains modest – annual +2.4%

According to Nationwide, UK house prices rose by 0.3% in October, maintaining steady growth and bringing the annual change to +2.4%.

Source: UK house prices rise by 0.3% in October – Reuters

The monthly uptick reflects a market finding its footing – helped by modest mortgage rate reductions. However, first-time buyer activity remains constrained, and the pace of growth continues to cool in higher-value southern regions.

What this means for SME developers:

The market isn’t booming, but stability offers clarity. Prioritise realistic pricing and future-proofing (e.g. EPC B or better) to meet lender and buyer expectations. Mid-market homes in well-connected areas are likely to remain resilient.

2. Vendor/seller caution ahead of Budget – listings and instructions fall

New data from RICS shows a sharp fall in vendor instructions, with buyer and seller sentiment weakening ahead of the Autumn Budget on 26 November.

Source: Housing market stalls as buyers wait for Budget – The Times

Speculation around potential tax changes, including stamp duty reform and capital gains updates, has prompted many to delay sales or purchases. This caution is compounding already-tight market supply.

What this means for SME developers:

Motivated landowners and sellers are increasingly rare – but may be more open to structured deals. Build flexibility into your offer strategy, and stay informed on any fiscal changes that might unlock stalled opportunities.

3. New-build land availability still tight – fewer greenfield and brownfield sites

Research from multiple land and planning consultants indicates that viable development land remains scarce, especially in high-demand regions. Supply pipelines for new-build homes continue to underperform long-term targets.

Source: UK Property Market Outlook – Clarity Development Finance

This presents a challenge for volume but also creates an opportunity for SME developers to step in with smaller, creative solutions – especially on infill or underutilised land.

What this means for SME developers:

Revisit ‘marginal’ sites, including tight plots, disused commercial units or unallocated land. Where access, community support, and policy alignment are strong, creative approaches can win.

4. Planning appeal workloads climb – decision times remain stretched

While digital appeals are beginning to roll out, Planning Inspectorate data shows appeal workloads increasing. Many developers are reporting slower decision times and reduced responsiveness from under-resourced planning teams.

Source: Planning delays continue despite digitalisation – Planning Resource

The system remains strained – and while reforms may bring future benefits, delays are the reality now.

What this means for SME developers:

Factor delays into your project timelines. Prior engagement with planning officers and full application packs reduce back-and-forth. A strong, complete initial submission is more important than ever.

5. Supply chain & build cost inflation – stronger than interest-rate headwinds

While mortgage rates have softened slightly following the August base rate cut, developers continue to face high build costs. Labour, materials, and fuel price fluctuations remain the top risk for many SME builders.

Source: UK Property Trends: Development Challenges – Portico

Build cost inflation has outpaced buyer affordability improvements, squeezing margins and requiring developers to value engineer without compromising quality.

What this means for SME developers:

Work closely with suppliers and contractors to control costs and reduce waste. Use up-to-date cost plans and QS inputs, and consider design choices that support speed, sustainability, and simplified build.

Steve Deutsch, CEO of CrowdProperty, comments:

“With price growth stalling and approvals becoming more complex, SME developers must focus on resilience, precision, and optionality. There are opportunities – in grey belt appeals, in build-to-rent, in digital reform – but success will favour those who do the groundwork thoroughly and respond quickly to a fast-changing landscape.”

And finally…

Here are five timely reads to keep you informed this month:

- What happens when EPC C becomes mandatory? – Construction Management

- The evolution of hybrid tenure models – Property Investor Today

- Build-to-Rent growth continues in regional towns – Knight Frank

- Spotlight on regional divergence in buyer demand – MoneyWeek

- Grey belt guidance – lessons from recent approvals – Evans Jones

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded