Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights for small and medium-sized property developers.

Key takeaways:

- House price growth stalls – flat in November, demand softens

- Budget brings tax clarity – but holding costs rise for high-value homes

- Planning pressures persist – backlogs and delays intensify

- Infrastructure funding protected – £120bn pipeline confirmed

- Cost inflation bites – materials, labour and energy squeeze margins

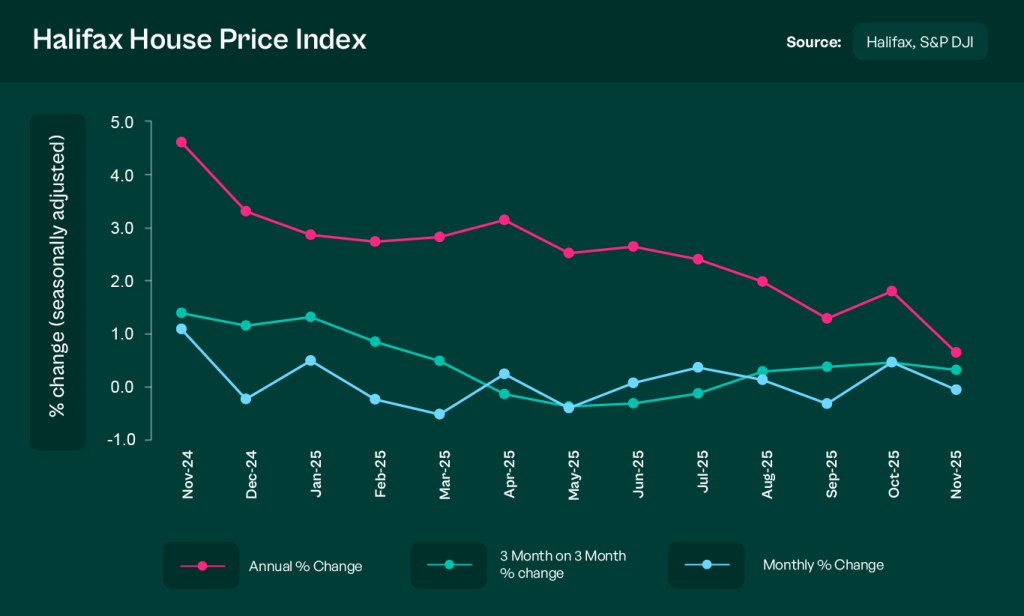

1. House price growth stalls – flat in November, demand softens

According to the Halifax House Price Index, UK house prices were unchanged month-on-month in November, with annual growth slowing to just +0.7%. This marks the weakest growth since early 2024 and reflects a more cautious buyer environment.

Mortgage approvals also dipped slightly, with many buyers adopting a wait-and-see approach in light of economic uncertainty and budget speculation.

Source: Halifax House Price Index

What this means for SME developers:

Price stability is holding, but forward momentum is modest. Developers should continue to focus on realistic pricing, mid-market housing aligned with local incomes, and EPC-efficient designs that appeal to value-conscious buyers.

2. Budget brings tax clarity – but holding costs rise for high-value homes

The 2025 Autumn Budget avoided sweeping reforms to Stamp Duty Land Tax (SDLT), which is welcome news for most buyers and developers. However, it did introduce a new High-Value Property Council Tax Surcharge for homes over £2 million, alongside higher tax rates on rental and property income.

These measures signal a strategic shift from transaction-based taxes to holding-based costs, particularly for landlords and owners of premium stock.

Source: Autumn Budget 2025 Key Takeaways – CrowdProperty

What this means for SME developers:

Budget outcomes are more benign than feared, but developers targeting the higher end of the market should review exit assumptions. Mid-market, affordable and energy-efficient homes are best placed to retain buyer interest. Avoid overexposure to luxury price bands where buyer appetite may weaken.

3. Planning pressures persist – backlogs and delays intensify

The Budget confirmed no significant planning reform acceleration, and the existing strain on planning departments continues. Appeals and variation requests are climbing, with many councils overwhelmed and decision cycles stretching further.

Digital appeals systems trialled this year are still in early adoption, and not yet impacting throughput in most areas.

Source: Planning appeal workloads climb – Planning Resource

What this means for SME developers:

Timelines remain a major risk factor. Plan conservatively, engage early with planners, and consider smaller or phased schemes where timelines can be managed more effectively. Avoid speculative applications without robust support and community backing.

4. Infrastructure funding protected – £120bn pipeline confirmed

Despite tighter fiscal conditions, the Budget reaffirmed a £120bn capital investment plan focused on transport, housing infrastructure and energy projects. This includes regional rail and road upgrades, local energy grids and regeneration-enabling funding.

While not all schemes will directly support development, this investment sustains the wider environment for unlocking land and improving project viability.

Source: Autumn Budget 2025 – PropertyWire Analysis

What this means for SME developers:

Track regional funding announcements — particularly those linked to housing infrastructure or brownfield regeneration. These often provide site-specific uplift and can improve both viability and deliverability. Infrastructure alignment can make marginal sites stack up.

5. Cost inflation bites – materials, labour and energy squeeze margins

Despite easing interest rate pressures, cost inflation remains the most significant constraint facing SME developers. The latest industry data highlights sustained pressure across labour, materials and energy – with subcontractor availability and regulatory compliance adding further complexity.

Build cost inflation has not dropped as quickly as expected, and many projects are still grappling with pricing volatility and delays across supply chains. According to recent construction cost assessments, inflationary pressures are now seen as a bigger risk to viability than borrowing costs for many smaller schemes.

Source: Rising Costs and Inflation: The Industry’s Relentless Pressure Point

What this means for SME developers:

Success hinges on accurate cost planning and flexibility. Build strong supplier relationships, lock in pricing where possible, and revisit value engineering options early in the design phase. With margins under pressure, disciplined procurement and tighter cashflow oversight will be key throughout 2026.

Steve Deutsch, CrowdProperty CEO, comments:

The Autumn Budget brought clarity without catastrophe — but the cost environment remains challenging. For SME developers, success in 2026 will depend on precise planning, conservative appraisals, and a deep understanding of local market dynamics. We continue to back those building with discipline, insight and ambition.

And finally…

Here are five timely reads to keep you informed this month:

- Autumn Budget Property Breakdown – PropertyWire

- What Budget property tax changes mean for the market – Zoopla Business

- UK housing market slows after tax‑raising Budget – Reuters

- Government confirms solar panels mandatory on new homes – Homebuilding

- Natural England nature‑offsetting scheme underperforms – The Times

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded