Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights for small and medium-sized property developers.

Key takeaways:

- Sales markets remain selective – opportunity in well-priced stock

- Rate stability supports structured, disciplined growth

- Refinance activity rising – proactive engagement pays off

- Planning reform signals long-term improvement

- Build costs stabilising – greater pricing clarity emerging

1. Sales markets remain selective – opportunity in well-priced stock

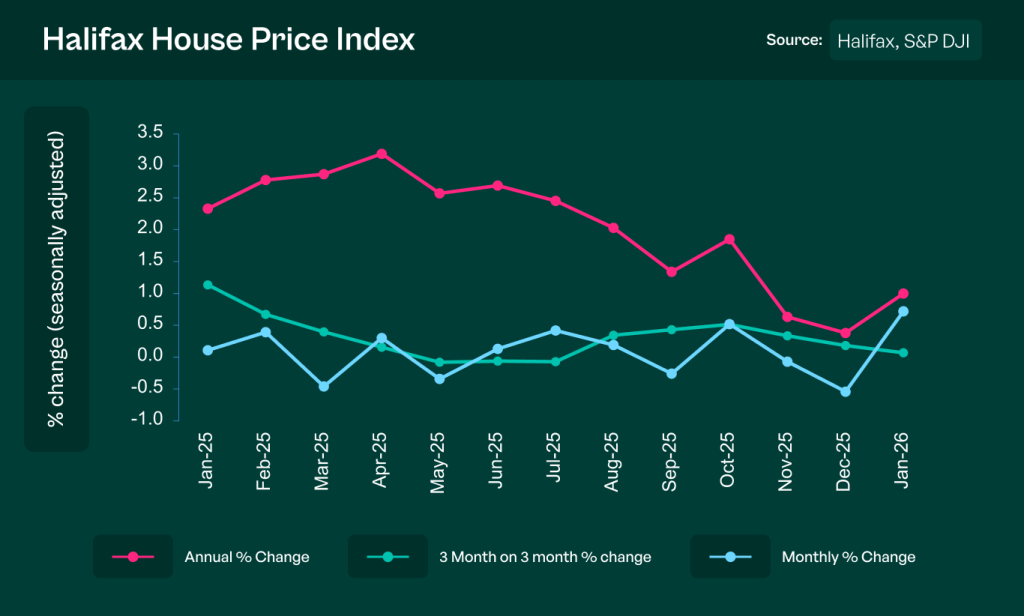

January saw modest annual house price growth, according to Halifax, but transaction volumes remain measured. Buyers are active where pricing is realistic and product aligns with affordability, particularly in mid-market segments and strong commuter areas.

This selective demand environment is rewarding competitively positioned developments. While broader market momentum is not accelerating sharply, steady absorption is evident for homes that meet local demand fundamentals.

Source: Halifax House Price Index – January 2026

What this means for SME developers:

There is liquidity in the market for the right product. Focus on homes aligned with local incomes, transport connectivity and energy efficiency. Realistic pricing and disciplined marketing can deliver steady exits even in a cautious environment.

2. Rate stability supports structured, disciplined growth

The Bank of England held the base rate at 3.75% in January, signalling a period of stability after late-2025 reductions. While rates remain higher than historic lows, the current environment provides greater visibility for financial modelling and funding strategy.

Lender pricing has remained broadly consistent, with underwriting standards stable and structured deals progressing where equity positions are strong and schemes are well-supported.

Source: Bank of England Monetary Policy Summary – January 2026

What this means for SME developers:

Rate stability allows for clearer planning. With disciplined structuring and sensible leverage, projects can move forward confidently. Early lender engagement and conservative stress testing remain key, but funding remains available for strong schemes.

3. Refinance activity rising – proactive engagement pays off

As schemes originated in earlier cycles approach completion or exit, lenders are seeing increased refinance discussions. This reflects longer programme durations and measured sales rates rather than systemic stress.

Developers who are engaging early, maintaining transparent reporting and protecting equity buffers are navigating refinance conversations constructively, with extensions and restructures achievable where fundamentals remain sound.

Source: UK Development Finance Market Update – January 2026

What this means for SME developers:

Review pipeline exposure early and plan refinance scenarios in advance. Proactive communication with funders reduces friction and protects optionality. Strong equity resilience continues to underpin favourable outcomes.

4. Planning reform signals long-term improvement

Government messaging continues to emphasise accelerating housing delivery and improving planning efficiency. While local authority timelines remain extended in parts of the country, digitalisation and reform proposals point toward gradual improvement.

The broader policy direction remains supportive of housing supply, particularly SME-led development on smaller and infill sites.

Source: GOV.UK Housing and Planning Update – January 2026

What this means for SME developers:

Programme conservatism is still prudent, but the strategic direction remains positive. Smaller sites with strong local backing and clear policy alignment continue to present viable opportunities.

5. Build costs stabilising – greater pricing clarity emerging

RICS construction data indicates that while build costs remain elevated compared to historic norms, the rate of inflation has moderated. Material volatility has eased, and pricing visibility has improved compared with prior years.

Contractor capacity remains regionally variable, but overall market conditions are more predictable, allowing for improved budgeting accuracy and tighter cost control.

Source: RICS UK Construction Monitor – January 2026

What this means for SME developers:

Greater cost clarity supports firmer feasibility assessments. Strong procurement discipline and contractor due diligence remain essential, but margin protection is increasingly achievable through careful planning and design efficiency.

Steve Deutsch, CrowdProperty CEO, comments:

January reflects a market returning to disciplined normality. Sales are selective but steady, rates are stable, and cost pressures are more predictable. Developers who combine realistic pricing, strong equity and robust structuring are well positioned to move forward confidently in 2026. In this environment, careful underwriting and operational discipline will be the difference between steady growth and unnecessary exposure.

And finally…

Here are five timely reads to keep you informed this month:

- UK construction trends set to shape the industry in 2026

- Hotspots for house price growth in 2026

- Fast-track planning reforms favour SME-led schemes

- UK construction skills shortage poses long‑term delivery challenge

- Planning reform underway – National Planning Policy Framework consultation

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded