Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights for small and medium-sized property developers.

Key takeaways:

- House price momentum slows at the end of 2025

- Demand remains selective despite tentative confidence signals

- Rates and cost of debt remain key constraints on leverage

- Planning delays persist across regions, extending programmes

- Construction cost volatility and contractor capacity strain margins

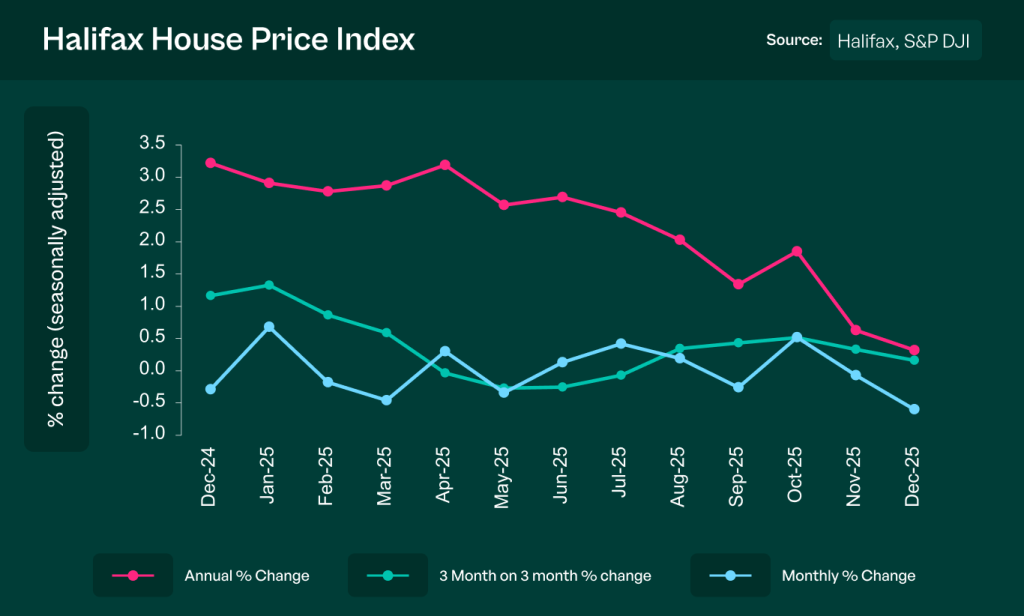

1. House price momentum slows at the end of 2025

UK house prices recorded a monthly fall in December, as reported in the Halifax House Price Index, with average prices slightly below the level seen in November. Annual growth also slowed compared with earlier in 2025, reflecting a softer end‑of‑year pricing environment.

Seasonal slowdown combined with subdued buyer activity contributed to this weak finish. Affordability challenges and cautious sentiment among buyers meant fewer transactions and less upward pressure on prices as the year closed.

Source: Halifax House Price Index – December 2025

What this means for SME developers:

Use conservative pricing assumptions in appraisals, and avoid overreliance on price growth in exit strategies. Target mid-market and affordable homes with broad local demand, and test values carefully before acquisition or refinance.

2. Demand remains selective despite tentative confidence signals

December survey data from estate agents revealed a slight improvement in sales expectations heading into the new year. The RICS UK Residential Market Survey found a positive balance in short-term sentiment for the first time in over a year, with some agents reporting stronger buyer interest in well-priced homes.

Despite these signs of stability, buyer demand remains highly selective. Affordability constraints, elevated mortgage rates and economic uncertainty continue to suppress activity in higher-value or secondary locations, limiting the potential for a widespread recovery.

Source: Taylor Wimpey warns of lower profit margins as demand stays muted – Reuters

What this means for SME developers:

Focus on well-located, energy-efficient homes in commuter and employment hubs. Speak regularly with local agents to understand current demand trends and pricing behaviour. Expect buyers to remain price-sensitive, and plan for longer sale times.

3. Rates and cost of debt remain key constraints on leverage

Although the Bank of England cut the base rate from 4.00% to 3.75% in late 2025, overall borrowing costs remain high by recent standards. Development finance providers continue to price risk cautiously, and most lenders have yet to materially reduce pricing or ease terms.

For developers, this means higher interest carry during the build phase, tighter stress-testing, and greater difficulty refinancing if market conditions shift. Combined with flat pricing, the cost of debt remains one of the most significant headwinds facing the sector.

Source: Property Development Market: Viability, Policy, and the SME Revival – LendInvest

What this means for SME developers:

Work with lenders early to structure deals conservatively, build in interest buffers, and stress test for potential rate changes. Prioritise well-funded schemes and avoid marginal projects that rely on aggressive assumptions.

4. Planning delays persist across regions, extending programmes

Delays in the planning system continued to impact housing delivery throughout December. Local authority capacity remains under strain, with extended determination periods, inconsistent responses, and appeals taking longer than expected. This was flagged again in several end-of-year sector reports.

These bottlenecks make it harder for SME developers to bring forward viable sites, increasing programme risk and tying up capital for longer periods. While reforms are underway, operational relief is unlikely to materialise in the short term.

Source: Challenges and opportunities facing small and medium-sized home builders – HBF

What this means for SME developers:

Plan for longer lead times and potential delays in securing full consent. Build flexibility into project timelines and funding strategies, and engage early with planning teams to avoid unnecessary hold-ups. Where possible, phase permissions to unlock earlier starts.

5. Construction cost volatility and contractor capacity strain margins

Construction costs remain well above historical averages. Material price inflation has eased slightly, but labour shortages, energy costs and regional contractor capacity constraints continue to drive price volatility. Smaller contractors remain cautious, particularly on fixed-price contracts.

This has direct implications for margin management and financial viability. Developers are facing pressure to absorb higher build costs or adjust specifications mid-project, both of which can erode contingency and stretch loan drawdowns.

Source: Rising Costs and Inflation: The Industry’s Relentless Pressure Point – CCBP

What this means for SME developers:

Build robust cost plans with clear contingency allowances, and maintain close oversight of procurement and contractor performance. Avoid aggressive assumptions on build costs, and factor in the potential for mid-project inflation or delivery delays.

Steve Deutsch, CrowdProperty CEO, comments:

December brought a quieter end to a turbulent year, but many of the same structural challenges persist into 2026. Developers still face margin pressure, slower planning decisions, and a cautious buyer base. Yet with price levels broadly holding and sentiment gradually improving, those with robust projects and disciplined planning can stay on the front foot. The coming months will reward smart site selection, lean delivery, and solid financial foundations.

And finally…

Here are five timely reads to keep you informed this month:

- The UK locations with the strongest house price growth prospects in 2026 – Money Week

- ONS: UK private rent and house price index – December 2025 – ONS

- We’re ready to build – SMEs on what’s holding back housing – Estates Gazette

- Developers draw confidence from improving landscape – London Loves Property

- Government policy takes a hit as housebuilding slows – Property Industry Eye

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded