Welcome to State of the Market, our monthly roundup of key property market updates, with actionable insights, tailored for small and medium-sized property developers.

Key takeaways:

- House prices dip for first time since May – mortgage approvals slip too

- Construction slowdown eases – signs of stability amid cost pressures

- Digital planning appeals launched – no second chances on evidence

- Grey belt appeals gaining ground – over 50% of major schemes approved

- Build‑to‑Rent investment surges – institutional capital backs rental scale

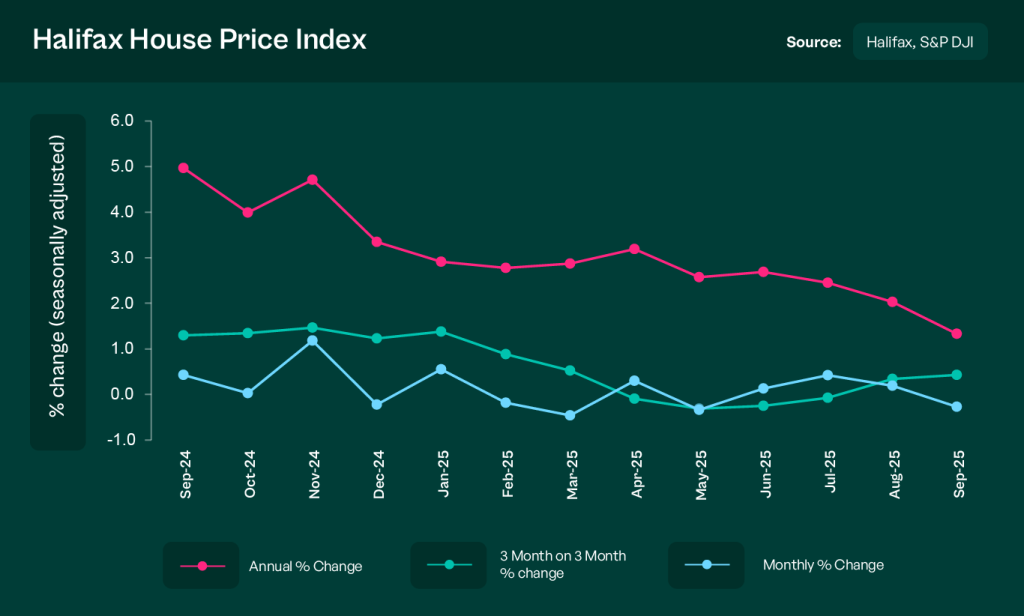

1. House prices dip for the first time since May – mortgage approvals slip too

UK house prices fell 0.3% in September, marking the first decline since May, with annual growth slowing to +1.3%, according to Halifax.

Source: UK house prices rise by least since April 2024 – Reuters

The drop coincides with a fall in mortgage approvals, which slipped to 64,700 in August, according to the Bank of England — a sign that buyers remain cautious despite the August rate cut.

Source: UK Mortgage Approvals Decline – RTT News

Sticky fixed-rate pricing, persistent affordability issues, and anticipation of further fiscal changes in the Autumn Statement have weighed on buyer activity.

What this means for SME developers:

Focus on affordability-led homes with strong EPC ratings in commuter and regional growth markets. Buyer budgets remain constrained, so developers must be realistic with pricing and allow for longer sale periods.

2. Construction slowdown eases – signs of stability amid cost pressures

The UK Construction PMI improved to 46.2 in September, up from 45.5 in August, indicating a slower pace of contraction.

Source: UK Construction PMI – Trading Economics

Though residential construction remains subdued, commercial and infrastructure activity are offering some offset. Inflationary pressures on materials and labour persist, but are gradually softening — providing room for cautious optimism.

What this means for SME developers:

Cost planning is still complex, but conditions may be stabilising. Engage with suppliers early, monitor lead times closely, and build resilience into your build programmes through contingency and phasing.

3. Digital planning appeals launched – no second chances on evidence

The Planning Inspectorate has confirmed that, from December 2025, most written representation appeals will be handled via a new digital portal — and only material submitted with the original application will be considered.

Source: A faster, more efficient planning appeals process – GOV.UK

This shift is designed to reduce delays, but it means less flexibility for developers to correct or add information during appeals.

What this means for SME developers:

It’s now critical to get applications right the first time. Invest in robust site assessments, high-quality supporting material, and strategic design to reduce the risk of refusal. Don’t assume the appeal process can fix weak submissions.

4. Grey belt appeals gaining ground – over 50% of major schemes approved

New analysis from planning consultancy Marrons reveals that 56% of grey belt appeals decided so far in 2025 have been allowed — highlighting growing support for releasing lower-quality green belt land where local housing need is acute.

Source: Majority of grey belt planning appeals allowed in 2025 – The Intermediary

The data suggests a growing willingness among inspectors to approve schemes that clearly align with the government’s “grey belt” criteria — particularly where proposals demonstrate design quality, sustainability and strong local justification.

What this means for SME developers:

Grey belt land is no longer off-limits. If a site is well-located, underutilised, and has a strong planning case, there’s a real opportunity. Developers should revisit previously discounted plots and consider assembling detailed, policy-aligned applications that can withstand scrutiny — especially where local plans are under-delivering.

5. Build‑to‑Rent investment surges – institutional capital backs rental scale

The Build-to-Rent (BTR) sector continues to expand rapidly, with the total UK pipeline exceeding 300,000 homes, according to new analysis from Knight Frank.

Source: UK BTR Market Update Q2 2025 – Knight Frank

Institutional investors are targeting regional hubs with strong rental fundamentals, with Cushman & Wakefield highlighting a 15% year-on-year rise in forward funding deals.

What this means for SME developers:

Larger players dominate the sector, but SMEs can benefit through partnerships or partial BTR exits. Consider mixed-tenure schemes or designing for rental viability from day one — this widens the pool of potential buyers or institutional acquirers.

Steve Deutsch, CEO of CrowdProperty, comments:

“With price growth stalling and approvals becoming more complex, SME developers must focus on resilience, precision, and optionality. There are opportunities – in grey belt appeals, in build-to-rent, in digital reform – but success will favour those who do the groundwork thoroughly and respond quickly to a fast-changing landscape.”

And finally…

Here are five timely reads to keep you informed this month:

- The changing shape of the rental landscape – Bdaily

- Legal changes in 2025 – what developers should be aware of – Macfarlanes

- Planning reforms 2025: Key changes and how to prepare – Geldards

- Why land sales in 2025 could look drastically different – Homebuilding

- A faster, more efficient planning appeals process – GOV.UK

Together we build

At CrowdProperty, we work in close partnership with the developers we back – solving site, funding and delivery challenges together. Our team of property experts visits sites, shares insights, and helps developers stay ahead of the market.

We’ve funded over £900million in property projects, backed by 300+ years of combined property expertise. Our distinct ‘property finance by property people’ approach means we truly understand what developers need – and how to help them grow.

Learn more about our story and our team

Apply in just five minutes and get an instant Decision in Principle. Our property experts will then share their insights and initial funding terms, and work with you to find the right solutions to support the success of your project.

Explore projects we’ve already funded