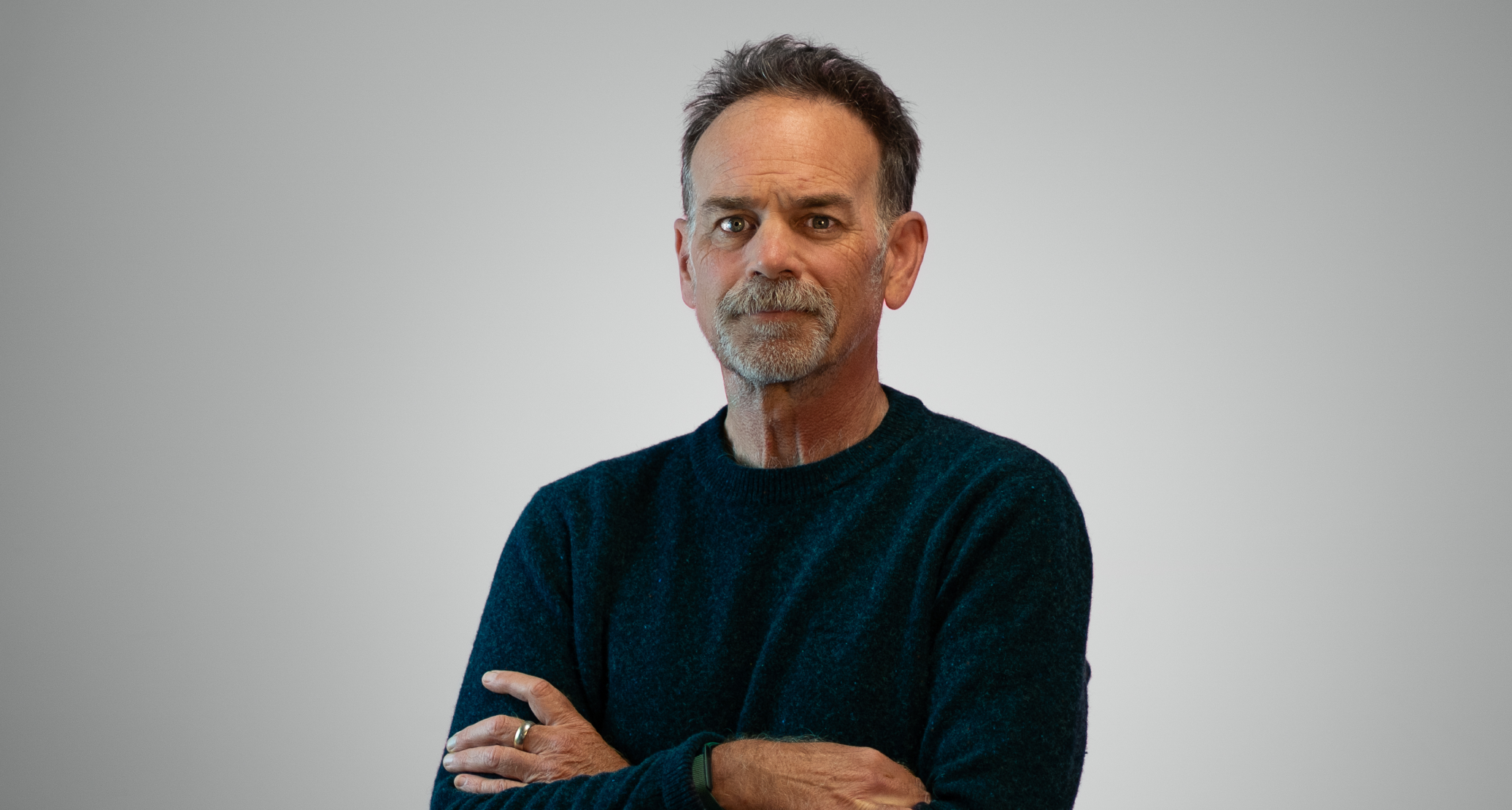

We’re pleased to welcome Rob Anderson to CrowdProperty as our new Head of Risk and Compliance. Rob will lead our approach to risk management, regulatory compliance and financial crime prevention.

As CrowdProperty focuses on delivering consistently strong outcomes for our investors and property developer customers, maintaining a robust and pragmatic approach to risk management, regulatory compliance and financial crime prevention is essential. Rob’s appointment strengthens this capability and ensures we have the right oversight, governance and controls in place to operate safely and sustainably.

Why Rob joined CrowdProperty

Rob was drawn to CrowdProperty’s purpose and the way we help open up property development investment to a broader community.

I really liked the model CrowdProperty has taken to enable retail investors to participate in the world of property development. The experience and credibility of the team was an important factor too, and it’s also great to be working back in Birmingham.

What Rob will be responsible for

Based at the firm’s Birmingham HQ, Rob will lead our approach to risk management and compliance across the business, helping ensure we continue to operate with the right controls as the business evolves.

Rob will focus on:

- Risk management frameworks that support sustainable decision-making

- Regulatory compliance, ensuring the right oversight and governance is in place

- Fighting financial crime, including the systems and processes designed to protect customers and the business

- Working closely with teams across CrowdProperty so risk and compliance enables growth, rather than slowing it down

In my role, I’m responsible for ensuring that CrowdProperty has the right approach to risk, compliance and fighting financial crime, helping the business develop safely while delivering good outcomes for investors and developers.

The experience Rob brings

Rob is a pragmatic and focused risk, compliance and change management professional with extensive financial services experience and a strong track record of delivering complex regulatory change.

His background includes senior leadership roles across banking, insurance and fintech, including:

- Head of Compliance at Moneybox

- Head of Conduct Risk & Compliance, Policy and Controls at Legal & General

- Senior Compliance Manager (Conduct Risk) at HSBC

- Senior risk roles within Lloyds Banking Group

- Managing consultant work spanning process and performance improvement, compliance, risk and customer experience

In recent years, Rob has delivered major programmes including the design and implementation of end-to-end control frameworks, closing significant audit points for clients, and guiding control assessment, testing and alignment to enterprise risk management rollouts. He has also led operating model and process redesign initiatives to achieve multi-year efficiency and cost-reduction targets.

What success looks like over the next 12 months

Rob is excited about supporting CrowdProperty’s momentum into 2026 – helping the business operate safely, while continuing to protect customers and strengthen controls.

I’m really looking forward to helping CrowdProperty grow successfully in 2026, and to enhancing our risk management and compliance approaches to support sustainable success.

Looking ahead

Rob’s appointment reflects our continued investment in strong governance and a robust control environment as we scale—supporting our mission to provide specialist property development finance with speed, ease and certainty, while delivering attractive returns to lenders.

Media information:

Andy Lacey | Head of Marketing | [email protected]

Other articles you may find interesting:

CrowdProperty technology update – November 2025

Embracing change – evolving the CrowdProperty brand

Developer Survey 2025 – how does the future look for property development?