Investors

Invest with confidence – earn up to 9.5% interest from expertly vetted property projects on a platform you can trust.

*Your capital is at risk. Past performance is not an indicator of future results.

What makes CrowdProperty different?

We combine trusted expertise with rigorous due diligence – giving you access to property-backed investments with strong potential and clear risk controls. Our track record and transparent approach set us apart in the market, helping you invest with clarity and confidence.

With competitive returns, straightforward processes and intuitive portfolio tools, we make property investing both accessible and rewarding. You stay in control – while our expert team works to protect your capital and grow your returns.

Our products

IFISA

Maximise your tax-free returns with our IFISA. Invest in property-backed loans while enjoying the benefits of tax-free income.

AutoInvest

Let your money work smarter with our AutoInvest feature. Automatically diversify your investment across a portfolio of property projects.

Pensions

Grow your pension fund by investing in property projects with CrowdProperty. Learn how you could maximise returns while building a more secure retirement pot.

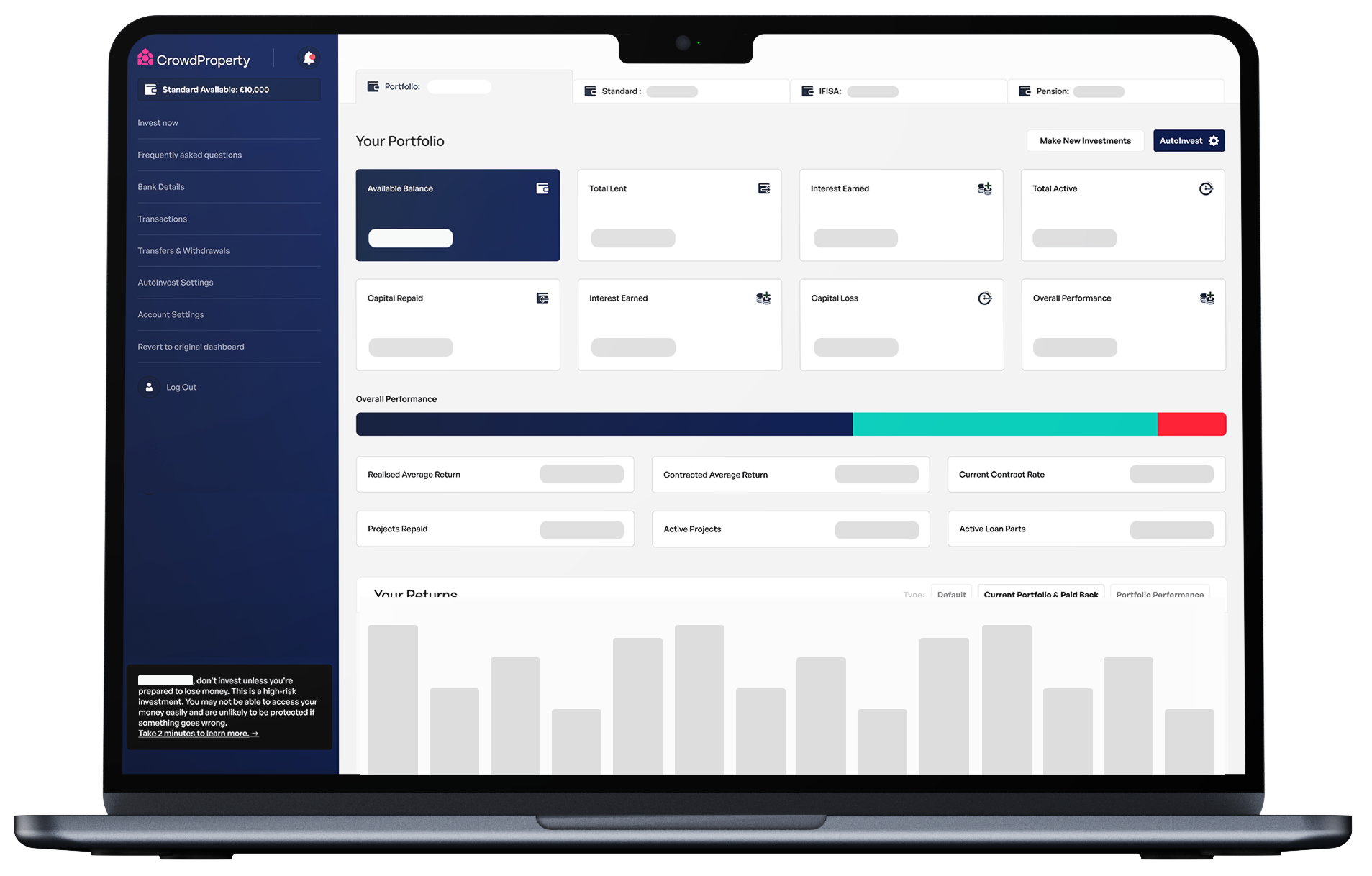

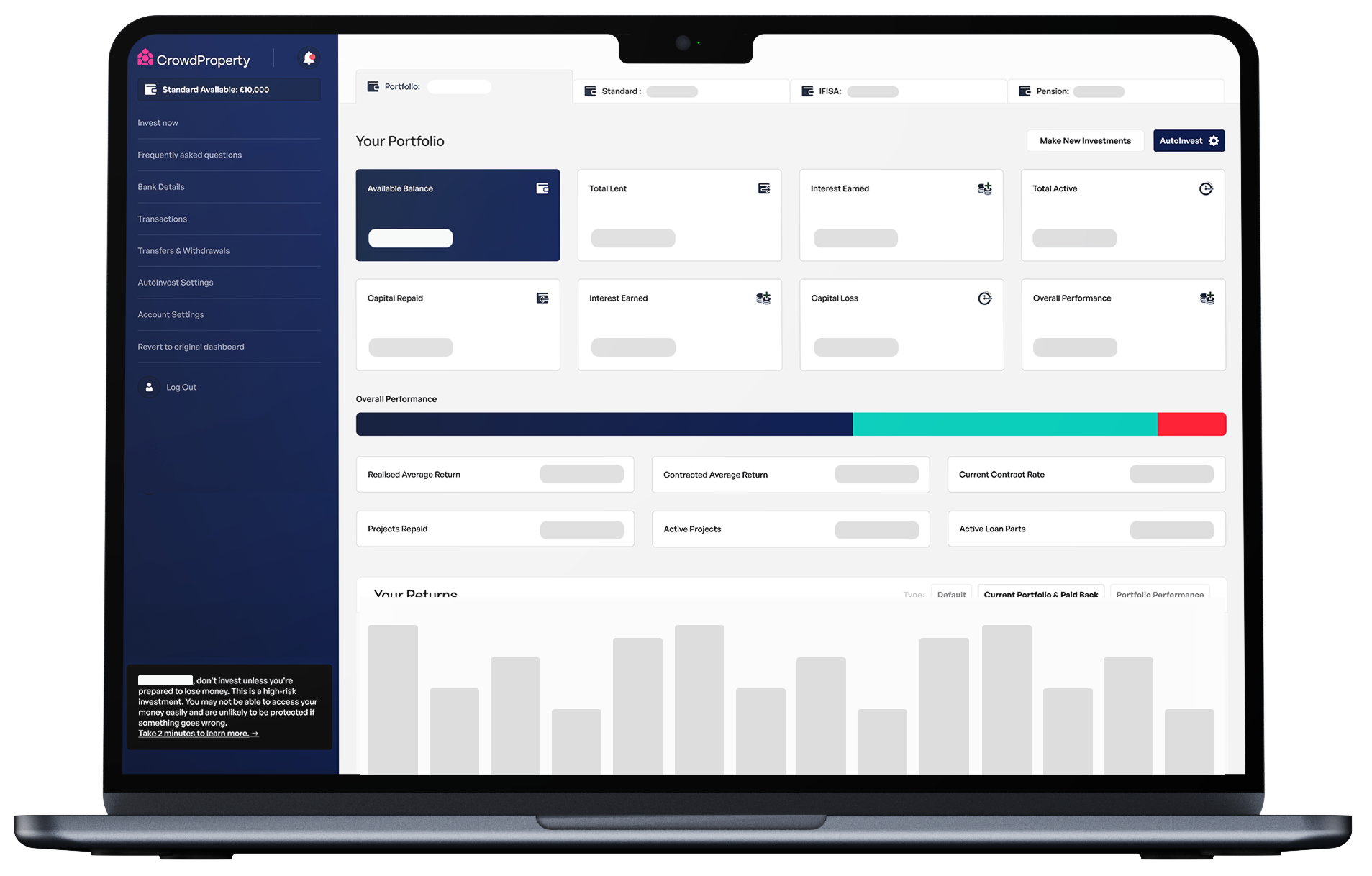

Investor portal

Stay in control with our intuitive investor portal – track performance, explore new opportunities, and manage your portfolio with ease, all in one place.

Investor Guide

Download your Investor Guide, packed with tips on smarter property investment, managing your portfolio, and maximising returns.

How we work

We make investing in property simple – every opportunity is expertly vetted, with clear information and regular updates from start to finish. You choose how you invest, and we handle the rest with care and precision.

Whether you’re hands-on or prefer to set and forget, our platform works around you – combining transparency, control and expert oversight to help you invest smarter and with confidence.

Register now

Join our investor community today. Speak with our dedicated investor desk on 020 3012 0161 or register below to get started.

Is there a minimum or maximum investment size?

The minimum investment amount per loan is £50. We currently do not have a maximum investment size, however we may introduce pledge limits on a project by project basis.

When will I be paid interest?

Interest is generally paid at the end of a loan term, however some projects do pay monthly interest. If a project is to pay monthly interest this will be stated on the project page.

How are loan repayments distributed?

During the facility lifecycle loan repayments will typically be generated from the borrower achieving unit sales (full or individual) or successfully completing a refinance facility.

In an enforced or distressed recovery the repayment will most likely be generated from CrowdProperty’s appointed agent, receiver or administrator successfully selling the asset having enforced our first charge security rights.

Upon crystallisation of the repayment amount, deduction will be made for all outstanding fees owed on the facility which will duly be distributed to the relevant parties. This may include enforcement fees and disbursements such as lawyers, agents, receivers or administrators, as well as CrowdProperty’s management fees.

Subsequent distribution of the net repayment amount will be processed according to whether the loan has been determined to be ‘performing’ or ‘non-performing’.

‘Performing’ loans are defined as those with the reasonable expectation of full recovery of all outstanding capital and interest. ‘Non-performing’ loans are defined as those where less than the full amount of capital and interest outstanding is expected to be received.

Performing loan distribution

If Credit have assessed the loan as ‘performing’ each repayment is considered to relate to outstanding borrower interest first, with any excess over the total interest due being processed as a capital distribution. Borrower interest is distributed as investor interest and CrowdProperty margin.

Borrower interest outstanding is processed as contractual period interest first, followed by any protection period interest.

Non-performing loan distribution

If Credit have assessed the loan as ‘non-performing’ each repayment is considered to relate to outstanding capital first, with any excess over the total capital recovered being processed as an interest distribution.

In situations where total borrower interest outstanding cannot be fully recovered, CrowdProperty margin is processed in the same proportion as any investor interest distribution.